This is the second part of a series concerning the collection and expenditure of severance tax dollars derived from the value of oil and gas produced in the state. Read Part I: The Politics of the Oil and Gas Severance Tax here.

Why should you be interested? Maybe one reason is revenue from severance tax collections reached over $240 million last year. But could Colorado be “leaving money on the table” that ultimately your tax dollars must cover?

Read on and find out…. Presentations to the Colorado Legislative Council’s “Interim Committee to Study the Allocation of Severance Tax and Federal Mineral Lease Revenue” in Rifle last week concerned the oil and gas boom that is affecting rural counties, especially on the Western Slope.

Presentations to the Colorado Legislative Council’s “Interim Committee to Study the Allocation of Severance Tax and Federal Mineral Lease Revenue” in Rifle last week concerned the oil and gas boom that is affecting rural counties, especially on the Western Slope.

Severance tax committee members were seeking an answer to this question: “Are governments and public entities being fully reimbursed by the state for the cost of these impacts?”

County commissioners, mayors, school administrators, housing authority members, road and bridge supervisors, human service workers and private citizens who spoke before the committee all said “no.”

In fact, if severance taxes are not fully covering the cost of impacts on effected communities, then local taxpayers are being forced to subsidize the difference, Duke Cox of the Western Colorado Congress explained to the legislative severance tax committee.

The severance tax collected from the income of oil and gas produced in Colorado should be used primarily to reimburse impacted local governments that need to fix damaged roads caused from the drilling trucks; or to help build new schools hit with the influx of industry workers and their families; or to expand city sewer systems and other projects. In a draft document circulated by Department of Local Affairs Director Susan Kirkpatrick last spring, projected capital-improvement and infrastructure needs in energy impacted counties, towns and special districts totaled $23.5 billion.

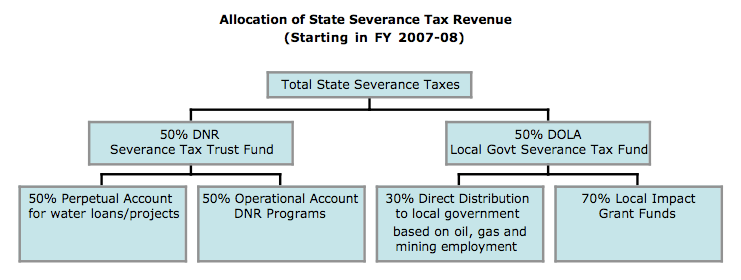

Yet, severance tax revenues also fund the Department of Natural Resources, the Department of Local Affairs and its grant program, (which recycles the severance tax back to the impacted communities,) and state water projects. In the past, monies have also been diverted from DNR to supplant the state’s operating budget and to even pay a water rights fine to Kansas. Currently, there is pressure to add higher education to the list.

If income from oil and gas severance taxes hasn’t met the needs of impacted communities, how can the state justify diverting more funds away from their DOLA programs?

One way to meet the demands on severance tax revenues is for the state to increase the severance tax rate. Rep. Kathleen Curry, D-Gunnison estimated that an increase of one percent on the state severance tax could generate up to $100 million in tax revenues.

Another way to raise income is to close the tax loopholes such as the ad valorem deduction and to fix the sloppy accounting of severance tax collections.

In a startling report by the Department of Revenue, possibly millions of dollars have not been collected because of the lack of auditing returns, improper metering at the well site and the misuse of ad valorem discounts. Also, “stripper wells” – wells that have low oil and gas production – are entirely eliminated from taxation, costing the state up to $19 million a year in lost revenues.

Ad Valorem Tax Deductions Equal Lost Revenue

Colorado’s unique ad valorem tax rule allows the oil and gas producer to deduct 87.5 percent of their assessed valuation payments to local governments from their severance tax due the state. No other state offers this huge deduction. (The only other state in the nation that offers an ad valorem discount is Kansas, but it totals only about 1 to 2 percent.)

“I don’t understand the concept of ad valorem tax deductions that energy companies use to reduce their severance tax payments,” Garfield County assessor John Gorman told the severance tax committee members. “It would be similar to me deducting local sales tax from the total state sales tax I pay,” he noted.

From the state auditor’s report:

At the state level, taxpayers are allowed an ad valorem severance tax credit for oil and gas production equal to 87.5 percent of their total local ad valorem tax. For example, if an oil producer has a severance tax liability of $50,000 and paid a total of $10,000 in ad valorem taxes, then 87.5 percent, or $8,750, can be applied as a credit against the severance tax liability. The resulting severance tax owed to the State is $41,250 ($50,000- $8,750=$41,250).

The Department of Revenue’s taxpayer information system does not track ad valorem credits taken against severance taxes. Therefore, we were unable to determine the actual amount of the ad valorem credits claimed on oil and gas severance tax returns.

However, due to the ad valorem tax credit, the majority of oil and gas tax filers do not have a severance tax liability. Rather, the majority of severance tax filings result in taxpayer refunds.

For example, for 2004, oil and gas taxpayers filed 8,007 severance tax returns with the Department of Revenue. More than 6,500 (81 percent) of these returns resulted in taxpayer refunds.

The state auditor’s office also noted that when and if the department does an audit of an oil and gas producer’s severance tax documents, more often than not, the auditor has found producers have over estimated their ad valorem discounts.

For example, one company the Department audited in 2005 had overstated its ad valorem credit in three previous years. The company overestimated the amount of ad valorem taxes it would pay and reported the estimate on its

severance tax return. This resulted in an overstatement of the credit used in computing the severance tax owed and in a refund for the company. When the actual ad valorem tax was used to calculate the credit, the taxpayer owed the State approximately $6 million.

“Why is Colorado giving millions of dollars in severance tax revenues back to the energy companies?” Gary Pack, superintendent of the Rifle area school system, asked the legislative severance tax committee referring to the ad valorem tax write-off. He noted those funds could be used to ease impacts on rapidly growing school systems in energy boomtown areas.

Good question.

More on Colorado severance tax collections and expenditures coming up in Part III of the series.

Photo of the severance tax committee panel in Rifle.